Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

| Used Car Research | Bad Credit Car |

| Bad Credit, Need | Direct Deposit Visa |

| Personal Credit Loan | Job Application Form |

| Sample Of Foreclosure | List Of Semi |

| Fast Easy Loan | New Homes For |

2.3 No Equity Loans

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. However, the word mortgage alone, in everyday usage, is most often used to mean mortgage loan. You can count on our payday loans from direct lender even in case your credit reputation is not clear or you dont have an official place of employment. In the market for a new car but worry that bad credit car sale your iffy credit score will put the brakes. Many other specific characteristics are common to many markets, but the above are the essential features. Servers, Bartenders, and all others that have trouble proving their 2.3 no equity loans real income can benefit from an equity loan with no documents.

Prerequisites for this course are next to none. Why not help the customer keep the home if at all possible. In some jurisdictions, mortgage loans are non-recourse loans. This MBA course and registration will be through the MBA Auction.

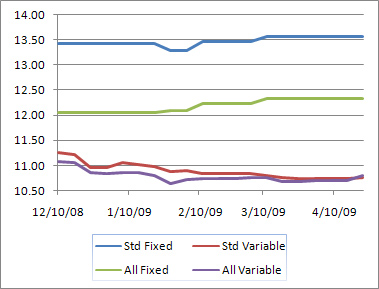

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. While they feature less technicalities compared to secured loans, they are harder to obtain. A mortgage is a form of annuity (from the perspective of the lender), and the calculation 2.3 no equity loans of the periodic payments is based on the time value of money formulas. In countries where the demand for home ownership is highest, strong domestic markets for mortgages have developed. Regulated lenders (such as banks) may be subject to limits or higher risk weightings for non-standard mortgages.

They carry higher interest rates and are to be returned within the period of a payroll cycle. Builders may take out blanket loans which cover several properties at once. Prerequisite for this course IS Fixed Income. This is a two way street, everyone has to listen and help. The professor will teach one MBA section and one Undergraduate section.

In some countries, such as the United States, fixed rate mortgages are the norm, but floating rate mortgages are relatively common. Bridge loans may be used as temporary financing pending a longer-term loan.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Autos provides research for used car research both new and used cars. This is because when you purchase a time share your loan is sold off and liquidated to an outside lender making the time share resort simply the ” trustee” on a warranty deed. Repayment depends on locality, tax laws and prevailing culture.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Do not get a credit card until you are familiar with its terms. Common measures include payment to income (mortgage payments as a percentage of gross or net income); debt to income (all debt payments, including mortgage payments, as a percentage of income); and various net worth measures. The Affidavit puts into words what the Application expresses in numbers. Hard money loans provide financing in exchange for the mortgaging of real estate collateral. Offset mortgages allow deposits to be counted against the mortgage loan. Enrollment for this course is by application only

As their name suggests, surface waves travel along the earth's surface. I am about ready to just close my checking account and stop paying them. Staysure co uk travel insurance tripadvisor on staysure insurance check this search query.

The amount of capital included in each payment varies throughout the term of the mortgage. Generally, personal loans offer flexible payment terms and come with a fixed payment schedule, interest rate, and periodic payment amount. Although the terminology and precise forms will differ from country to country, the basic components tend to be similar. This could be the next big adjustment in the banking system. Any amounts received from the sale (net of costs) are applied to the original debt.

A study issued by the UN Economic Commission for Europe compared German, US, and Danish mortgage systems. Copyright © The Weissman Center for International Business. Commercial property that is underwater is huge and the borrowers will walk away because they don't care they're corporations and individual credit will not get hurt. In some jurisdictions, foreclosure and sale can occur quite rapidly, 2.3 no equity loans while in others, foreclosure may take many months or even years.

Buydown mortgages allow the seller or lender to pay something similar to mortgage points to reduce interest rate and encourage buyers.[7] Homeowners can also take out equity loans in which they receive cash for a mortgage debt on their house. The purpose of these loans is to help students who are looking for funds to pay their college expenses. Thanks Ralph, I couldn't of said it better. Some lenders may also require a potential borrower have one or more months of "reserve assets" available. Some people feel a moral obligation to pay.

NO Fee Typing Jobs

Student aid is designed to enable students to complete their education and are either offered through private lenders or the federal government. The interest is rolled up with the capital, increasing the debt each year. No more multiple payments, just one single payment. In the event of repossession, banks, investors, etc. For loans made against properties that the borrower already owns, the loan to value ratio will be imputed against the estimated value of the property. Budget loans include taxes and insurance in the mortgage payment;[6] package loans add the costs of furnishings and other personal property to the mortgage.

From short term payday loan and cash advances to hedge against unexpected emergencies to long term auto and home mortgage designed to finance your prized asset purchases, lenders offer highly customizable financial aid for almost any financial situation you might have. Interest rates may be low and repayment 2.3 no equity loans terms are very convenient. All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender's risk. Combinations of fixed and floating rate mortgages are also common, whereby a mortgage loan will have a fixed rate for some period, for example the first five years, and vary after the end of that period.

There are also various mortgage repayment structures to suit different types of borrower. In many countries, the ability of lenders to foreclose is extremely limited, and mortgage market development has been notably slower. What would also make sense is for the Banks to offer to discount those same second mortgages to their customer. The R/T got a unique interior with a center tachometer, "Z-stripe" seats, 2.3 no equity loans "spider monkey" wheels, fender stripes, and red LED ambient lighting. In the United States, the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have (as of 2004) reached about 6 per cent per annum.

Vedemos carros recolhidos de finacinamento, comprar carros baratos temos disponivel de v rios. This is because in some countries (such as the United Kingdom and India) there is a Stamp Duty which is a tax charged by the government on a change of ownership. According to Anglo-American property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan. There will also be requirements for documentation of the creditworthiness, 2.3 no equity loans such as income tax returns, pay stubs, etc.

I work collection for many years and sold a lot of mortgages and notes to the borrowers parents, friends, relatives. In other words, the borrower may be required to show the availability of enough assets to pay for the housing costs (including mortgage, taxes, etc.) for a period of time in the event of the job loss or other loss of income. Nations lending corporation is an fha, direct mortgage lender va, harp, irrrl and streamline. In contrast, lenders who decide to make nonconforming loans are exercising a higher risk tolerance and do so knowing that they face more challenge in reselling the loan. There is a way already coming to replace traditional credentialling.

A standard or conforming mortgage is a key concept as it often defines whether or not the mortgage can be easily sold or securitized, or, if non-standard, may affect the price at which it may be sold. Many countries have a notion of standard or conforming mortgages that define a perceived acceptable level of risk, which may be formal or informal, and may be reinforced by laws, government intervention, or market practice. In addition to the two standard means of setting the cost of a mortgage loan (fixed at a set interest rate for the term, or variable relative to market interest rates), there are variations in how that cost is paid, and how the loan itself is repaid. It is used commonly in loans with a loan-to-value ratio over 80%, and employed in the event of foreclosure and repossession. This can be a good loan for certain situations, but is not a loan for everybody. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed and on moving house further borrowing is arranged on a capital and interest (repayment) basis.

I was given a complete discharge of my debts, including the equity loan. In addition to this broad umbrella of funds and financial aid, there 2.3 no equity loans are various subcategories that you may wish to learn about. Graduated payment mortgage loan have increasing costs over time and are geared to young borrowers who expect wage increases over time.

While Credit.com always strives to present the most accurate information, we show a summary to help you choose a product, not the full legal terms - and before applying you should understand the full terms of products as stated by the issuer itself. The value may be determined in various ways, but the most common are. Apply today for fast cash or payday fast online cash loans loan from cashnetusa com through a.

However, gross borrowing costs are substantially higher than the nominal interest rate and amounted for the last 30 years to 10.46 per cent. This type of mortgage is common in the UK, especially when associated with a regular investment plan. For example, a standard mortgage may be considered to be one with no more than 70-80% LTV and no more than one-third of gross income going to mortgage debt.

NO Credit Check Installment Loans In Spartanburg

Fannie Mae Dips Further 2.3 no equity loans Into Foreclosure Pool. Features of mortgage loans such as the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably. Because ownership changes twice in an Islamic mortgage, a stamp tax may be charged twice. I would like to attend graduate school, but I am certain I would not be approved for any loans because of my credit score. Subject to local legal requirements, the property may then be sold. A - If you have not tried already, please use your ten digit Cenlar loan number when registering on the website.

For further details, see equity release. Mortgage loans are generally structured as long-term loans, the periodic payments for which are similar to an annuity and calculated according to the time value of money formulae. Islamic mortgages solve this problem by having the property change hands twice.

A risk and administration fee amounts to 0.5 per cent of the outstanding debt. In one variation, the bank will buy the house outright and then act as a landlord. In this way the payment amount determined at outset is calculated to ensure the loan is repaid at a specified date in the future.

There may be legal restrictions on certain matters, and consumer protection laws may specify or prohibit certain practices. This gives borrowers assurance that by maintaining repayment the loan will be cleared at a specified date, if the interest rate does not change. Flexible mortgages allow for more freedom by the borrower to skip payments or prepay. In practice, many variants are possible and common worldwide and within each country.

Over this period the principal component of the loan (the original loan) would be slowly paid down through amortization. A debit card (also known as a bank card or check card) is a plastic card that provides the cardholder electronic access to his or her bank account(s) at a financial institution. The main alternative to a capital and interest mortgage is an interest-only mortgage, where the capital is not repaid throughout the term.

However, real estate is far too expensive for most people to buy outright using cash. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but because most mortgages occur as a condition for new loan money, the word mortgage has become the generic term for a loan secured by such real property. In most jurisdictions, a lender may foreclose the mortgaged property if certain conditions - principally, non-payment of the mortgage loan - occur. Second mortgages and Home Equity Lines of credit offer considerable risk in today's enviorment, but there is an integraty issue here also. I just SAVED $23.72 and got Free Shipping before Christmas arrival too. Clinical educator training cet is required for all school district personnel and.

Debt consolidation is a financial assistance that generally offered by the lenders to enable you to consolidate and repay a variety of debt obligations through one easy loan. Keep all original documents and send copies. Many countries have similar concepts or agencies that define what are "standard" mortgages. Balloon payment mortgages have only partial amortization, meaning that amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding principal balance is due at some point short of that term, and at the end of the term a balloon payment is due. If you sign up for the Refund Processing Service which enables you to deduct certain fees and any applicable tax from the proceeds of your tax refund, you authorize Intuit (through its third party processor) to debit these amounts (excluding the Refund Processing Service Fee) from the bank account you identify as your Direct Deposit Bank Account in the event that you do not receive a tax refund that is sufficient to pay for them.

The price at which the lenders borrow money therefore affects the cost of borrowing. Smith was coaching Louisville when he began investing in real estate, which he has said, was profitable until land values took a nosedive. If you are self employed, then a no doc equity loan might be for you. You need to follow particular procedure free loan agreement forms pay day loans that i can have into my. If you have been working at the same job for over 2 years and have a strong income, then you should avoid this loan.

Personal Loan

Commercial mortgages typically have different interest rates, risks, and contracts than personal loans. In most countries, a number of more or less standard measures of creditworthiness may be used. The act allows a lender to assess a prepayment penalty during the first three years of the loan, with the maximum permissible penalty being 3% in the first year, 2% in the second, and 1% in the third. The mortgage company will check your credit and as long as your credit is good enough and you have enough equity, then you get the loan. The cost of buying a new car, and the sales lease a new car tax that goes with it, is spiraling. This policy is typically paid for by the borrower as a component to final nominal (note) rate, or in one lump sum up front, or as a separate and itemized component of monthly mortgage payment.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research