Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

400 Fico Car Loan Lenders

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. This removes the objects mass from either side of the equation. Gorham said that in many cases, customers dont need down payments and consumers with FICO scores as low as 400 are getting auto loans. Following are a few samples of real life examples of sales letter marketing and sales letters that were. Even the built-in rip-off interest rate and “driving off the lot” fee is more of a racket than ever with the automatic score-lowering inquiry model built in. You might not even be able 400 fico car loan lenders to get a car you like.

Prerequisites for this course are next to none. Most banks and credit companies choose not to become involved in transactions with customers with a poor credit score, in order to avoid any unpleasant circumstances that might arise out of the customers inability to pay back the loan. I received a loan offer from the dealership when I got there, but continue to get mail from one after another credit offers for a Ford vehicle. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Today, if you have a job, and theres equity in the loan” thats it, Ed Gorham, director of the finance department at Planet Honda in N.J., told The Wall Street Journal. But most of these cards have high fees, including but not limited to 400 fico car loan lenders annual fees, monthly membership fees, and a one-time joining fee. Since its introduction 20 years ago, the FICO® Score has become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries. A public record like a lien has a negative effect on your credit score and may also affect whether or not a lender extends credit to you.

Subscribe to our sister publication, Auto Finance News. Norton holds a Bachelor of Arts in history from the University of Central Florida and a Juris Doctorate from The University of Iowa. Prerequisite for this course IS Fixed Income. Experian and TransUnion later developed separate scoring systems that are similar to FICO scoring. The professor will teach one MBA section and one Undergraduate section.

So even if you have a very low FICO score, we can get you approved and rebuilding your credit with an auto loan in no time. Since the objective of this entire exercise is to repair your credit score and find a bank willing to give out a loan, its important to be ready to pay back at least one installment.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. As an added bonus, you will save money in the long term 400 fico car loan lenders because you will end up paying less in interest. Use of this web site constitutes acceptance of 400 fico car loan lenders the eHow Terms of Use and Privacy Policy. No one tells you that there is no grace period, $10 a day late charge everyday your late. The beauty of secured credit cards is that after a year of timely payments the bank may unsecure your card and give you a higher limit.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

You can see that working to get your score in the higher ranges can mean a big savings. Theres only one thing that could go wrong with that strategy. This also can help you get better terms on your loan. Shop around for a vehicle that is dependable and efficient, and that you can afford. FICO scores comprise payment history, balances owed, new credit, types of debt and average length of credit accounts. Enrollment for this course is by application only

Payment history has the largest impact of the FICO factors and amounts to 35 percent of the overall score. In 1958, FICO developed the first method of rating credit. Ellie Norton began writing in 2006 and her articles have appeared on Ehow.com, Examiner.com and Associated Content.

The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. The company also sells a mortgage score, a medication adherence score, insurance risk score, a bankruptcy score, and even as score that tells how much revenue your account would generate. Fortunately, this is a great place to make that happen.

I make a very good income and could pay almost any car payment but the system punishes you for your past mistakes. The Wall Street Journal spoke with a Honda dealership finance department director who claims he can finance consumers with low credit scores and small or no down payments. I need to wait until my loan is paid off before I try getting a car so I can have a higher score. This means that you have not been delinquent on any accounts in that time.

A FICO credit score of any less than 400 will pretty much ensure that you will not be able to get approved through traditional lenders such as banks. Her writing and editing have appeared in "The Daily Illini," "The (Anderson, Ind.) Herald-Bulletin," and she has ghostwriten for numerous companies and organizations worldwide. Your score directly determines the interest rate you’ll pay on your loan.

Microlending works by pooling lenders who agree to short-term (usually around three years) loans to people of varying credit ratings. A personal transaction will put you into a car, sometimes even without interest. Yes I just went to a car dealership after cleaning up my credit report. Click here to learn more about the industry's leading newsmagazine or here for VIP access.

Short Sale Hardship

Mastercard payment gateway is a. Making regular payments on these loans can help repair your credit rating. Some used car dealerships get financing from investment firms who cater to investors seeking high rates of return on their money. You may be able to qualify for an FHA mortgage; this is because FHA mortgages do not have a score requirement, only that you have clean credit for the last 12 months. Right now, you can't see your FICO score with the Auto Industry Option because it isn't offered to consumers. Another such lender is Ford Motor Credit; however, they pay close attention to your annual income.

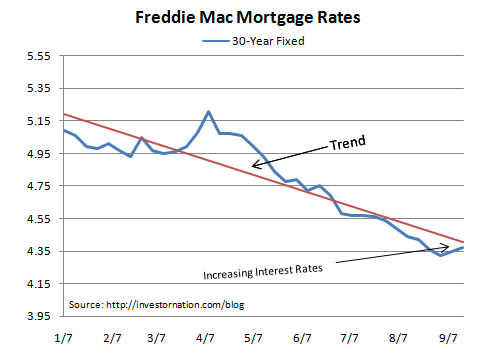

Using a 30 year fixed mortgage as an example, you can see the difference in rates between someone in the low 600 range and someone in the high 700 range. The chart at the right clearly shows that consumers with high FICO® scores are lower risk. The number of consumers with subprime credit scores purchasing vehicles was up in the fourth quarter, meaning more people with bad credit are able to get approved for car loans. Initially the company recorded data for analysis that Fair and Isaac believed companies could use when making business decisions. Articles and videos from the ny times on auto loans and car sales, including.

Get all papers and necessary documents in order. These include identification documents, bank receipts, income payment copies, proof of residence and other official papers required for applying for a loan. People with low credit scores or subprime scores can qualify for car loans, but they often pay extremely high interest rates. You'll even find flat file cabinets for extra-large items, and fireproof 400 fico car loan lenders models to help protect your documents from heat, fire and water damage.

She took many English and creative writing classes in college. The hard reality is that, with a low credit rating, you might not be able to get the car you want. Then, my daughter goes to get a new car, I offer to sign due to her being young and having no credit yet, and they tell her I have a 0 for a credit score.

In doing this, banks find out your FICO credit score, along with the two other types of credit scores that are out there and likely recorded for you, and use this information to determine whether or not you will be approved for the loan. My daughter would have had a much lower interest rate had I been able to cosign PLUS due to where I worked, she was to get a hefty discount on the car she chose. As you can probably imagine, having poor credit makes it very difficult to get approved for loans. Make your payments on time to avoid paying fines to your financial institution to get your car back. Our cash advance loan services are a quick cash advance loans online solution for your immediate online. This message brought to you on behalf of North Carolina Attorney General Roy Cooper.

Generally, people with higher scores pay lower interest rates, although many large banks charge flat interest rates regardless of credit scores. Balances owed amount to 30 percent of the FICO score, and people with high balances score poorly in this category. If you are looking for dealers other than buy here pay here consider those with "guaranteed financing all you need is a job"-understand they still require a job and minimum income, and XX% down.

The rates shown are averages based on thousands of financial 400 fico car loan lenders lenders, conducted daily by Informa Research Services, Inc. If you're a savvy auto loan shopper, you check your credit score before walking into the dealership. Sooo against my better judgement (and under severe stress) I agreed to get the car. Your FICO score has versions other than the one you're given through providers like MyFico.com.

At first, the billion settlement natl mortgage settlement seemed like a blessing. FICO credit scores range from 300 to 850, with higher scores indicative of stronger credit history. I printed out my score and offered to take it to the dealership, to no avail. You would be surprised how easy things can come up on your credit report that do not belong to you. As a Fulbright Scholar, she taught English at Hanoi Pedagogical University No.

However, if you can't pay the entire price of the car upfront and you and the previous owner agree to payment terms, be sure to put everything in writing to protect yourself. When you apply for a loan, lenders will look at one or more of your FICO® scores. People who have difficulty getting conventional financing can try to get a personal loan through websites like Prosper.com.

Banks look at applicants' levels of debt relative to their gross income when reviewing car loan applications. Find a co-signer, often a parent or other family member, who agrees to pay off your car if you fail to make payments. Lucena city, philippines employment job hiring at lucena jobs available ceiling carpenter. Get up to with a fast cash loan.

Any time you apply for a traditional loan through a bank or other financial institution, it is common for them to ask you for your social security number along with other personal information so that they can run a credit check. Dealers that use Credit Acceptance Corp are an example. I asked what was up and they said they run it on a different level.

Jobs local jobs find local job hiring your perfect job now. Badges | Report an Issue 400 fico car loan lenders | Terms of Service. I have an Experian credit score of 780, which is awesome. Many people with poor credit turn to dealerships that claim to finance everyone. I must have letters from 20 creditors who all ran checks from one online request through Ford – which I consider a reputable site.

This is especially true if you are in need of a car loan as soon as possible. Cars for sale classifieds in cagayan valley region post used car classifieds. I don’t think my current honda will make it that long. You don't want to end up defaulting on another loan. These loans are secured, meaning they are backed by some sort of collateral.

When I applied online, I feel like they sent my request to every auto credit agency on the planet. I have worked in auto sales for ten years, and I have never heard of this one. One such company is Fingerhut; they have a catalog full of items from computers to TVs that you can purchase with the credit they extend you. If you choose to go this route, shop around for the best rates, and read and understand your contract fully. If this is something you'd like have access to, write to FICO expressing your interest. This often is true, although dealerships that offer direct financing to people with shaky credit usually do so at a price.

Large numbers of credit inquiries negatively impact the scoring in the part of FICO that scores new credit. About a month ago, I went online to Ford.com and applied for a loan. Many people with low credit scores feel that they will never own their own home. Generally, debt-to-income ratios on car loans cannot exceed 45 percent.

The rate of interest under long term loans for poor credit may not be always sounding. Different lenders can request your FICO score with Industry Options. I worked for an Experian credit reporting site and I found that your credit scores given through these online sites, no matter what they claim, are NOT used at car dealerships, nor do they make a difference when going for a bank loan, loan adjustment, etc.

First off, when I was approved, I had no idea that at the time it was Drive, and now they are Sandtander, that my interest rate would be ridicuously high. Review of austin conveyance austin conveyance did a great job moving me. Ask someone with a higher score to cosign an application with you or take out a secured credit card. An increased consumer demand might encourage the offering of the FICO score Industry Option versions used by various lenders. While interest rates are dropping for consumers with good and prime credit scores recently, consumers should know that they will most likely receive a very high interest rate if they have bad credit and will need a considerable down payment.

One of which is the Auto Industry Option used by auto lenders to approve your car loan. Repossessed equipment from ges sales, marketing, and repossession. Microfinance is gaining popularity as people try to avoid the high rates and other costs associated with big financing corporations. The reason consumers with good FICO® scores get better interest rates is because they pose less risk of missing payments or defaulting on a loan. I am definitely just saving up and paying cash.

Austin Conveyance

When it comes to taking out a car loan, a credit score of 400 is a poor 400 fico car loan lenders rating that will undoubtedly hamper your chances of receiving the loan.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research