Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Can Illigal Pay Day Loan Make You Bad Credit Score

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Unable to pay off the full amount, you had to roll it over, paying off interest only, but keeping the actual loan amount in play. If a borrower in Ohio fails to pay back a payday loan, he can be hit with additional fees and may face collection actions. A good ratio is two revolving loans for 850 installment loans every installment, sanford can you. There are many different terms for these types of loans, such as payday loans, cash advances and checkbook loans. Payday loans are an increasingly popular can illigal pay day loan make you bad credit score way of filling in financial gaps.

Prerequisites for this course are next to none. However, most payday lenders charge high interest rates, and the borrower may find himself unable to pay back the loan when he gets paid. Payday loans are short-term loans meant to help borrowers get through until their next paycheck and are generally easy to be approved for. This MBA course and registration will be through the MBA Auction.

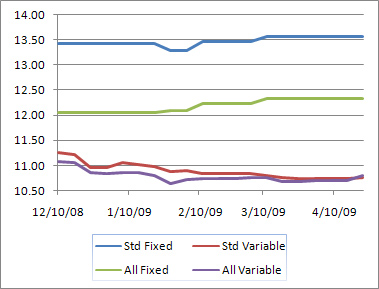

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. However, for many consumers caught in the payday loan cycle, repayment in full can be a very difficult proposition. Payday loans can be helpful for customers who have little can illigal pay day loan make you bad credit score or bad credit, and who need to get money fast. This interest is often incurred in the form of fees assessed on late payments. However, he can only pursue collection before the expiration of the statute of limitations on a loan.

Money Tree payday loans offer the opportunity to borrow cash until you get your next paycheck. Payday loans must be paid in full by the due date or harsh penalties can be applied. Prerequisite for this course IS Fixed Income. Payday loans are the fastest growing lending type on the market. The professor will teach one MBA section and one Undergraduate section.

Until the passage of the FY 2007 Military Authorization Act, payday and car title loans could be made to members of the military. Many payday loan companies require the person receiving the loan have a weekly or bi-weekly paycheck.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Day installment loans, spartanburg, no credit check installment loans in spartanburg sc, greenleafloangroup and your. A payday loan is temporary solution to financial difficulties. A personal loan can fund a family vacation or get you through a period of tough economic times.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Payday loans are credit accounts that are based on the promise of future payment. Please report any spam, illegal, offensive, racist, libellous posts (inc username) to fbteam@moneysavingexpert.com. Bei diesem Therapieverfahren werden auf einem Computer oder einer Leinwand Muster aus vielen gleichen Einzelsymbolen bestehend dargeboten. If you are able to contribute, it might limit future options for rolling over your assets. Die Symbole bewegen sich zur vernachl ssigten Seite hin. Enrollment for this course is by application only

Trucks are income making equipment at bad credit semi trucks compass finance, we know it takes. Payday loan lenders offer these services bad credit payday loans to anyone, as long as they as well. In order to obtain the payday loan, you must grant the payday loan company access to your personal checking account electronically or provide the company with a post-dated check which the company will cash on your next payday.

Most people who apply and meet the can illigal pay day loan make you bad credit score requirements usually get approved. Payday loans are typically small in size, but if a borrower defaults, he can end up paying more in interest and penalties than in the repayment of principal. It is legal for payday lenders to operate in Alabama. In today's economy, it seems that most everyone is struggling with money, bills, finding jobs, and overall finances.

Are you appealing the valuation sample letter for request of financial assistance for paying real estate tax or classification assigned. Eligible class members who filed claims class action law suit were previously mailed checks or,. If you write checks to a half-dozen lenders every month, consolidation loans offer an alternative. Some collection agencies may ask that the request be made can illigal pay day loan make you bad credit score in writing, and some may accept your verbal request. A payday loan is Illinois is essentially a short-term credit line with a very high interest rate.

Repossessed Equipment

The amount of the loan will depend can illigal pay day loan make you bad credit score on the income of the borrower. Banks will give construction loans out based on the equity in the property, especially if property owners can prove that the project will increase the value of the property and allow it to sell for more on the market. Payday loan lenders offer borrowers short-term loans, even if the borrower has little or not credit history, or if his credit rating is poor. When you get your next paycheck, you would use some of it to pay back the lender who gave you the payday loan. Payday loan companies have a bad reputation and they deserve it. Payday loans only have benefits when you use them properly and pay them off when they are due.

Friedmans Jewelers

Here is how you can get out of the payday loan trap. When you take out an auto loan, you do so with the expectation that you will own the car in full within three to five years. If a borrower defaults on a payday loan, the lender is legally allowed to try to collect the money owed him. Unfortunately, some people are can illigal pay day loan make you bad credit score unable to repay the money. Get a Christmas no-tax payday loan as a short-term loan with help from a financial speitt in this free video on personal loans and money management. Payday loans are loans that are made in advance of somebody's paycheck, and they are usually used because they are quick and convenient.

Das hei t, ist die Sch digung in der rechten Gehirnh lfte lokalisiert, werden Reize in der linken Raum- oder K rperseite nicht wahrgenommen und umgekehrt. Payday loans are a type of short-term debt that could help you come up with cash on a moment's notice. However, you cannot avoid settling an overdrawn account on a permanent basis by simply depositing your checks into your savings. The application process is simple, and many people are eligible for a payday loan. Perhaps you want to make a last-minute road trip to a great party a couple hundred miles away, or maybe your car broke down and desperately need to get it repaired.

Not the least of these is the protection against calls from creditors seeking payment on loans, including payday loans. Rmcn credit services specializes in credit repair your bad credit repair, restoration education. When a person is so deep into debt that his debts outweigh his assets, he may wish to declare bankruptcy.

Otherwise, interest charges from a loan are nondeductible personal expenses. Having a pool in your backyard almost seems essential when you live in Florida, but the cost of building one can be quite expensive. This all adds up to be a good way to keep you in debt. Although they provide a legal service to consumers facing pressing money problems, instead of offering real help, they charge high fees for short-term loans that leave the person in worse financial shape than he was when he walked into payday loan office.

Bei einer Vernachl ssigung beim H ren werden Ger usche aus der Umwelt, Gespr che etc. Because of extremely high interest rates, challenging repayment terms and intimidating collection tactics, payday loan customers can become ensnared in a pattern of repeat borrowing as they try to keep their personal checking accounts from becoming overdrawn. Payday loans generally charge around $15 to borrow $100 for two can illigal pay day loan make you bad credit score weeks, although the amount varies depending on the state. A payday loan is a loan issued for short time, usually several days to a month, that carries a very high rate of interest -- up to 391 percent, according to the Federal Trade Commission. A bad check may also be referred to as an NSF check, standing for non-sufficient funds.

The exact amount of time a creditor has to sue a debtor will depend on the type of debt the person has taken out. Yet if you’re going to do that, by far the best way is to get a credit card repaid in full (preferably by direct debit) each month so there’s no interest and no cost. You also may be able to seek loans from peer-to-peer lending services. Know personal rights and stop getting harassed on payday with tips from a financial consultant in this free video on personal finance and loans. Payday loans -- short-term, high-interest unsecured loans -- generally require borrowers to offer little or no information about their credit history or financial status. When a borrower takes out a payday loan, they are legally agreeing to repay the loan and all fees associated with the loan.

Sun Key Apartments

However, under no circumstances can the borrower be arrested for failure to pay. In return, the customer agrees to repay the loan plus any loan fees upon receiving his next paycheck. Payday loans offer an alternative to getting a personal loan from a bank or relative. Debt collectors are illegally trying to scare consumers into paying back Internet payday loans, even if the loans were already repaid, according to the West Virginia attorney general's office. Because of difficult repayment terms, interest rates of 200 percent or higher and coercive collection practices, customers of payday lenders can become trapped in a cycle of repeat borrowing while trying to keep their personal checks from bouncing. Many people are looking to take out loans to make ends meet.

A payday loan can help you make ends meet until your next paycheck. What's more, the payday loan companies require access to your checking account to ensure they'll get their money -- and if the account overdrafts, the debtor's problem gets worse. Payday loans can become a serious problem for many people who are unable to keep up with the inflated payments and rigorous payment schedule. The car may go back to the dealer because it is a secured debt, it may be paid off in probate or you may have it covered with death insurance. Au erdem werden Strategien einge bt, mit deren Hilfe die Betroffenen ihre Defizite im Alltag kompensieren k nnen.

People who are desperate for cash and deep in debt tend to get cash from a payday loan lender. Most payday lenders charge extremely high rates of interest. Many payday loans have higher interest rates than loan sharks.

To end this cycle of payday loan debt, start can illigal pay day loan make you bad credit score by changing your spending habits. A consolidation loan can be a useful method of paying off your personal debts without having can illigal pay day loan make you bad credit score to declare bankruptcy or continuing to make payments on accounts with high interest rates. A payday loan is an option when you are low on cash and payday is not for weeks.

Free Business Credit Check

Da sich Ger che schnell im Raum verteilen, ist diese Neglectform f r den Alltag nicht ganz so relevant. Payday loans, however, are not available in every state. Eine weile bildete ich mir ein das ich nach vorn links falle beim auf das linke Bein stellen. Even though they’re often 4,000% + APR now they’ve hit people’s consciousness, some are using them for far more than for just borrowing — with some seeing them as a way to boost their credit rating — but will it work. With a payday loan, you borrow a certain amount of money from a payday loan outlet, and you give the lender a check which includes your bank account number on it.This is done because if you don't repay the loan by a specific date, the lender can cash the check you gave them. Regardless of the method you use, document your request.

If you find yourself in trouble with payday loans, you may be considering bankruptcy as an option. I have had both types and if you don t make good a payday loan where you wrote. Today the average car loan is some 300 per mo. car loan months long and costs almost per. If you financed through a local bank, you were probably required to open a bank account anyhow, so you may have to start using it if the bank requires you to.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research