Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

| Payday Loan Online | Letter Of Credit |

| Quicken Loans Refinance | 4.0 30 Yr |

| House For Rent | How To Write |

| Bad Credit Car |

Cards For Poor Credit

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. As the name implies, there is not security deposit made to obtain an unsecured credit card. And it’s hard to beat an annual fee of $29 – secured cards almost always come with a fee, but they often hit $35 or more. Apply for your personal loan online and receive cash in hours. You may be able to get the annual fee waived if you ask. You probably won’t find a card with any lower than 15% APR, cards for poor credit and you probably won’t qualify for a rewards credit card.

Prerequisites for this course are next to none. A user can increase his credit limit at any time by simply increasing the amount of money on deposit up to the card’s limit. The USAA offers a low-interest, lowish-fee secured card to those in the military. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

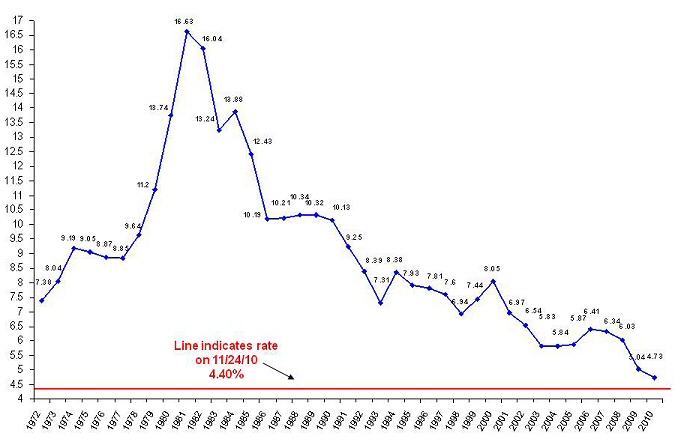

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. For such transactions, interest begins to accrue from the date of the advance. Prepaid cards are often advertised as an option for people cards for poor credit with bad credit, but these aren't really credit cards. Looking for the best credit cards for bad credit. If you dedicate some time to building your credit and establishing responsible spending habits, you could soon graduate to a card with better interest rates and even some rewards.

Some prepaid credit cards market specifically to low-credit consumers looking for a break. They often have free checking with no minimum deposits. Prerequisite for this course IS Fixed Income. Prepaid cards require you to make a deposit before you can use it to make purchases. The professor will teach one MBA section and one Undergraduate section.

Looking for a credit card but have bad credit. Once you’ve built up some solid credit, you can close the account, get your deposit back, and graduate to a card with lower APR and fees.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Mortgage rates are likely to stay 4.0 30 yr mortgage rates below through the middle of, look. Their “$500 unsecured credit limit” is baloney, too. It has really helped me to build up my credit score, and now I have a “real” credit card from cap one.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

You can check out sites like TrueCredit.com, which charges a monthy fee of $16.95 that avoided if you cancel your membership within 7 days. They all provide the legally required protection against unauthorized use as well as online account access. Vanquis Bank can be contacted at its registered office at No. Fees in addition to interest charges are a fact of life for credit cards for bad credit. If you have bad credit you may have to start out with a credit card with less attractive interest rates and lower credit limits, initially. Enrollment for this course is by application only

Whether it's good or bad news, it's critical to know what is in your credit report. MI Money Ltd is a tied credit intermediary of Capital One (Europe) plc and promotes the Luma card exclusively in partnership with Capital One (Europe) plc. Rather it should be used only until qualifying for a more advantageous card is a reality.

Then read the reviews of the cards that best meet your personal needs before making your choice. The Granite card is promoted by MI Money Ltd and issued by Vanquis Bank Limited. If you’re short on cash, no worries.

Retail stores have a reputation for approving applicants who have bad credit. They may be called account set-up fees or program fees but whatever the name, they’re a charge required for the extension of credit. First Premier does in fact offer credit cards, but the fees are exorbitant and hard-to-find. Remember that these cards are intended to be a stepping stone on the way to an excellent credit record and it’s a reasonable goal to expect to discard them in favor of a better option after a period of satisfactory use. Federal credit unions are prohibited from charging interest cards for poor credit rates higher than 18%, even if you miss a payment.

For example, if you have a $300 credit limit, make certain cards for poor credit you are not being charged more than $75 in fees. You can pay the deposit in installments, for as long as 80 days after signup. At kia of east syracuse we will help bad credit car loans you finance that new or used vehicle. The Credit CARD Act of 2009 limits the fees that can be charged in the first cards for poor credit year — and guess what, the First Premier hits exactly that limit. Please note that NerdWallet has financial relationships with some of the merchants mentioned here.

Motorcycle Dealers In St Louis Missouri With Bad Credit

For example, the Capital One Classic Platinum approves applicants with credit scores as low as 577 according to CreditKarma.com. In general, credit unions have lower APRs and fees and will oftentimes waive late fees and penalty APRs altogether. There are no fees for debit usage or monthly charges. It’s unfortunate but, across the board, customer service for credit cards in this category is weak compared to other credit cards. Use our side-by-side comparison charts to determine which card best meets your individual requirements. But if you’d like to avoid credit altogether, then the PerkStreet Financial debit card is a great option.

If managed responsibly, even a bad credit credit card can give you the opportunity to rebuild and improve your credit in order to qualify for better rates and terms in the future. Credit Cards for Bad Credit can be very good things when trying to establish a credit history or to repair a seriously flawed one. By now we’ve pretty well established the necessity to have a credit card in today’s financial world. Compare credit cards and choose from both secured and unsecured credit card offers below. Should you choose to proceed, our partners may charge you fees for their products or services.

If the APR is higher than 30%, run far, far away. Is there a scheduled credit limit increase, or similar program. Vanquis Bank Limited is authorised and regulated by the Financial Services Authority. It gives 2% cash back on travel and 1% back elsewhere, and has no foreign transaction fees – key for visits home. This is not to say that these are prepaid cards.

Unfortunately, the purchase grace period cards for poor credit doesn’t apply to cash advances. Days ago these credit cards are specifically for people that have bad credit or poor credit. Fast cash payday loans online with aaapaydaycash com. Their cards won’t get you very far.

We’ve compared the best of these cards alongside one another in the above matrix. To actually withdraw the funds, the account must be cancelled and refunds generally take several weeks to be processed. There are, however, generally very substantial limitations and charges associated with these cards. Some will reward up to 4% of your average daily balance each year. There are some credit cards aimed specifically at people who have bad credit.

Many secured credit cards can be converted to unsecured cards for poor credit credit cards after a year of on-time payments. The Capital One Secured MasterCard is one of our favorites. Who would want to pay interest on their own money. We recommend checking out our Credit Report Review for the very best ways to get your hands on that information. About Us | Press Room | Give us a Shout | Privacy Policy.

We rank the best rewards credit cards for bad credit with side by side. When you apply, the bank checks your credit history to decide whether you give you a secured or unsecured credit card. People with bad credit have the fewest options for credit cards. Kathy ward s trips, recommended destinations, kathy ward tacoma wa and places traveled on gogobot.

You could find yourself drowning in high interest rates, hidden fees, and fraudulent lending practices. There’s often a higher rate applied to cash advances than for purchase transactions, so if you expect to take such advances regularly, pay particular attention to that rate. Credit Cards for Bad Credit fill the gap between prepaid credit cards and the generally more desirable cards described in our Credit Card and Rewards Credit Card reviews.

Quick Easy Private Lenders

Some of the money can be used to take care of the application fee and the rest can be put toward your credit card balance. Please verify FDIC Insurance / NCUA Insurance status, credit card information, and interest rates during the application process. If you have bad credit and are in the market for a credit card, fasten your seat. Take a look at the characteristics of each card to narrow your search. As discussed above, credit limits are essentially set by the consumer for secured credit cards based on the security deposit that is made. Put some serious thought into whether it would be more beneficial to use a card with high fees and a low interest rate or low fees and a high interest rate.

Looking For A Used Car

Compare Credit Cards | Credit Union Finder | Bank Information | Find Cheap Gas | Discounts | Rates | Infographics | Our Blog. It’s easy to qualify for them even with a poor credit history or none at all and, most importantly, they report monthly to each of the three major credit reporting agencies so that successful use of them can eventually result in qualifying for better cards. Here is our list of the best credit cards for bad credit, and a few other helpful pieces of information to help you in your search. Yes, you'll have a low credit limit starting out, but that's true of unsecured credit cards for bad credit, too. Make a bigger deposit…get a higher credit limit. If you have bad credit, look into your local credit union.

Some even give back 1-2% on your spending. The prepaid account will not be reported to the credit bureaus as a credit card. There is a host of free online math games for 4th grade math practice fourth graders that will give them the. Presuming that that you’re able to stick to that plan, the grace period can be even more critical than the stated interest rate. You have a better chance getting approved for a limited purpose credit card that can only be used at that store rather than a credit card backed by Visa or MasterCard.

Thankfully, Capital One offers a card specifically for immigrants that has no annual fee and even offers rewards. Though Federal law limits the amount of fees to 25% of the credit limit, at least one subprime credit card issuer has gotten around the law by assessing a $90 fee before the credit card is ever issued. When shopping for a credit card for bad credit, keep in mind that the card should be regarded as a stopgap measure…this isn’t the card that you want to use for the rest of your financial life.

If you sign up and receive a card, you’ll get a piece of plastic that pays exclusively for items on their websites, which to boot, are overpriced. These cards offer credit toward their outlet stores, which pose as legitimate credit lines. These card companies will nickel and dime you, too.

They can even be the first step towards other credit opportunities such as an automobile loan or a home mortgage. The Credit CARD Act of 2009 states the total fees paid in the first year may not exceed 25% of your credit limit. People with bad credit have the fewest options for credit cards.

The majority of help comes from online account access but fortunately, that’s usually all that is needed.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research