Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

| Job Vacancies | State Max Car |

| Rim Financing | Rent Homes |

| Freezing A Bank | Business Capital 4k |

| Refinance Your Auto | Undergraduate Loans |

| Toyota Revo Brand | Craigslist Seattle Rent |

Max Finance Companies Can Charge For A Use Car Loan In Ca

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Also, the lender is permitted to use all collection methods against the cosigner such as law suits and garnishment of wages. Let our eHow experts help you through the loan process with this beginners guide to loans. Listings include no fee new york city and rent homes manhattan apartment rental listings,. It is almost always in the best interests of a person with a charge off on their credit report to approach the lender and attempt to resolve the problem. For information on these laws, contact your state’s consumer max finance companies can charge for a use car loan in ca protection agency or Attorney General’s office.

Prerequisites for this course are next to none. The comments section describes the current status of your account, including the creditor’s summary of past due information and any legal steps that may have been taken to collect. Find out if there are any restrictions on the amount of money the creditor will lend for the car you are interested in. This MBA course and registration will be through the MBA Auction.

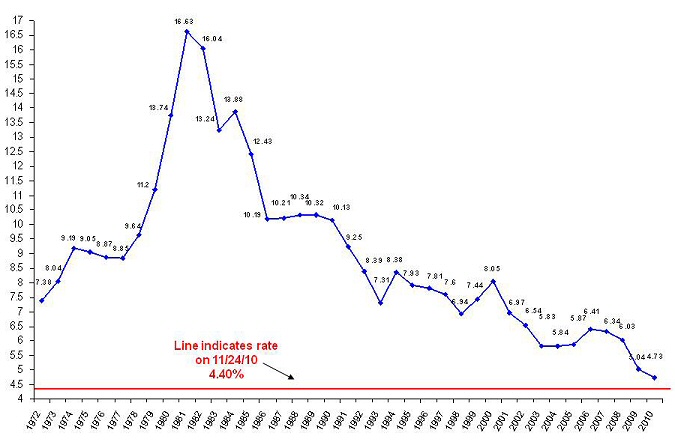

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Also, choosing economy types may not necessarily be in your best interest when trying to secure an auto loan in any financial situation. With that in mind, experts counsel those involved in auto loans to max finance companies can charge for a use car loan in ca do anything and everything they can to protect their investment. Another important consideration is the mileage limit — most standard leases are calculated based on a specified number of miles you can drive, typically 15,000 or fewer per year. In some cases, buyers use “direct lending.

When a car customer with a lot of financing cant pay on time, an auto loan charge off might happen. Getting an car loan charge off during bankruptcy will is not the same process as when you fail to make payments and your lender eventually writes off the loan and more than likely repossesses the car. Prerequisite for this course IS Fixed Income. Many times, this will be a significant amount of money. The professor will teach one MBA section and one Undergraduate section.

However, the majority of borrowers who think their credit is poor could qualify for regular loans. Lenders also look at consumers financial situation.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Markets regulator sebi on wednesday ordered freezing of bank accounts of two. The credit contract shows the buyer how much more max finance companies can charge for a use car loan in ca it costs to buy on credit than to pay cash. It allows consumers to call one number to notify credit reporting agencies and credit card companies of identify theft. Savvy buyers need to comparison shop for money just as they do for the car itself.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

The finance charge is the total cost of the loan including interest, fees and credit checks. Make sure you ask your dealer if the model you are interested in has any special financing offers or rebates. Since the bank, finance company or credit union does not deal directly with the prospective vehicle purchaser, it bases its evaluation upon what appears on the individual’s credit report and score, the completed credit application, and the terms of the sale, such as the amount of the down payment. He earned a Bachelor of Arts in political science from the University of Massachusetts. The request and obtaining of a permission letter can take up to a month to acquire. Enrollment for this course is by application only

In some cases, a creditor will resubmit a charge off every time they sell the obligation to a credit collection company. One indicator is the consumer's current credit score. For an automobile lease, the lessor must additionally disclose the annual mileage allowance and charges for excessive mileage; whether the lease can be terminated early; whether max finance companies can charge for a use car loan in ca the leased automobile can be purchased at the end of the lease; the price to buy at the end of the lease; and any extra payments that may be required at the end of the lease.

Keep in mind that you are what is termed a "high" risk so do not be surprised that these rates will be a lot higher than normal prime. A short-term loan finalizes the purchase of the car but can result in a high monthly payment and a lofty interest rate. Cars in this category are sometimes associated with less than acceptable safety features that put potential lenders off. This may mean offering to make multiple payments or one financial payment that resolves the entire credit obligation.

In some cases, your trade-in vehicle will take care of the down payment on your vehicle. You may be required by the creditor to have a co-signer sign the finance contract with you in order to make up for any deficiencies in your credit history. When a charge off has been done, it may look like the damage is done, and the situation may seem to be completely in deadlock. In that case, if the cash price of a car financed in Indiana was over $3,100; the original borrower and the cosigner may receive a deficiency judgment which would force repayment of the difference.

For each account, the credit report shows your account number, the type and terms of the account, the credit limit, the most recent balance and the most recent payment. So if you are considering financing through a dealer, make sure you get separate quotes for the car and for the financing. Putting a face on the negotiations is an important step towards a successful transaction. The APR is the standard way of max finance companies can charge for a use car loan in ca talking about interest rates.

In direct lending, a buyer agrees to pay the amount financed, plus an agreed-upon finance charge, over a period of time. The contract must include the APR, the amount financed, the finance charge, the total of payments and the payment schedule. Although your ability to pay—taking into account all your bankruptcy requirements—is an important decision-making factor, lenders will also examine the type of vehicle you have when making a loan.

Can Illigal Pay Day Loan Make You Bad Credit Score

Some car buyers mistakenly think that because the vehicle has been repossessed, the debt is canceled, but this is not the case. But at the end of a lease, you must return the vehicle unless the lease lets you buy it and you agree to the purchase costs and terms. Dealers typically sell your contract to an assignee, like a bank, finance company or credit union. Some consumers disregard their own self interest in money matters. Every state has a usury limit the state max car interest rates in florida maximum legal interest rate. To be sure the lease terms fit your situation.

Fair Credit Reporting Act — Gives consumers many rights, including the right to one free credit report each year. Get all the information you can from each and compare the rates offered. The F&I Department manager will ask you to complete a credit application. In most states, if the borrower misses one payment, the creditor can collect from the cosigner immediately without contacting the borrower first.

Charge offs can remain on a credit report for seven years or longer and may even be reported repeatedly as a new unpaid financial obligation. He has written in literary journals such as Read Herrings and provides written online guides for towns ranging from Seymour, Connecticut to Haines, Alaska. Information on this application may include. Keep in mind that in most cases, you will be responsible for an early termination charge if you end the lease early.

Car financing companies and other lenders can legally pick up a vehicle from the street or even a property owner's driveway. If you are considering leasing, there are several things to keep in mind. Lab find monthly morgage payment file.

The additional debt load should not cut into the amount you’ve committed to saving for emergencies and other top priorities or life goals. Factors such as income and the down payment determine the length and interest rate of the loan. Some states have higher rates, such as Massachusetts, which is at 20 percent.

For this reason, you should exercise caution if asked to co-sign for someone else. But the sale amount may not be sufficient to cover the balance owed. Otherwise, it would seem that the debt-ridden car buyer would have little reason to pay up for the charge off amount. However, as stated earlier, many creditors attempt to keep charge offs at the top of recent unpaid credit obligations by repeatedly reporting charge offs. Some states have no limit, such as Maine.

They value convenience and the promised "no fuss" policies of dealerships. More often than not, a visit with a potential lender will allow you to personally explain reasons you had that compelled bankruptcy. Also, ask about additional fees such as credit checks and max finance companies can charge for a use car loan in ca the finance charge, which is the total cost of the loan.

Generally, after the charge off, the negotiations begin about how to address the situation. Apply for new car loans, used car loans, or auto loan refinancing at the official. If you decide to negotiate with a credit to resolve a charge off, make sure you get any agreements in writing and retain proof of payment so you can have the negative credit statement removed from your credit report. Having a charge off placed on your credit report does not usually mean that you are relieved of the credit obligation. Keep in mind that even a low interest rate and perfect finances can cost the consumer more.

You also want to know the creditor's legal rights for situations such as late payment, default or prepayment. A co-signer assumes equal responsibility for the contract, and the account history will be reflected on the co-signer’s credit history as well. Let eHow's experts guide you through the world of financial freedom with tips and tricks on how to evaluate risk, choose the best investments for your portfolio and more. If involved in a Chapter 13 bankruptcy procedure, all your financial max finance companies can charge for a use car loan in ca activity is controlled by a court-appointed trustee. In some situations, such as when you are denied credit, you may be able to obtain additional copies for free.

However, it does put them in what most people would agree is a decidedly detrimental position. If the loan's term is three years with a 5 percent interest rate, the consumer actually pays $23,737 to the loan company. A used car buyer may know how to find the best models and how to reach a fair price, yet not know how to buy a car on credit. The “Monthly Spending Plan” can help determine an affordable payment for you.

In many cases, a charge off will have less and less impact over time - if it is not repeatedly reported as a new credit charge that has not been paid. If you want to get a good deal, you must investigate all the sources of financing and select the deal that best meets your needs. But if the loan's term is five years with a 5 percent interest rate, the consumer pays $25,510 -- $1,773 more than the three-year loan. A charge off will stay on a credit report for up to seven years. In addition, the amount of the debt may be increased by late charges and attorney fees.

Sometimes buyers, who are ineligible to sign a loan contract because they are under age, need a cosigner for a used car loan. Once a buyer and a vehicle dealership enter into a contract to purchase a vehicle, the buyer uses the loan proceeds from the direct lender to pay the dealership for the vehicle. If you exceed the mileage limit set in the lease agreement, you’ll max finance companies can charge for a use car loan in ca probably have to pay additional charges when you return the vehicle. Carbuyingtips com guide to saving money by refinancing your current auto loan.

The process of looking and applying for a personal or business loan can sometimes be difficult and confusing. This can extend the impact of a charge off well beyond the initial seven years. Understanding stocks, bonds and other investment vehicles can seem overwhelming.

The dealership may retain the contract, but usually sells it to an assignee (like a bank, finance company or credit union), which services the account and collects the payments. All of these events will have an adverse effect on the borrower's credit history and may damage the cosigner's credit record as well. Make sure you understand every clause of the contract. It’s a good idea for you to check your credit report, as well, to make sure the information is accurate, complete, and up-to-date before you apply for a loan for a major purchase like a car.

Compare different lease offers and terms, including mileage limits, and also consider how long you may want to keep the vehicle. Use of this web site constitutes acceptance of max finance companies can charge for a use car loan in ca the eHow Terms of Use and Privacy Policy. Many times, an auto loan charge off will go hand in hand with a car repossession, max finance companies can charge for a use car loan in ca and both of these events can happen quickly; when the driver least expects them. So if you fail to make your payments, then legally the creditor can repossess the car and sell it.

Dealerships In Hampton That Specialize In Low Credit

You may see these specials advertised in your area. However, if consumers' financial situations fluctuate or they didn't adequately prepare for the long term, those monthly payments can eat up income and savings. An extensive list of job vacancy and recruitment job vacancies agency websites in new zealand. Surfing the net can help identify these willing lenders. However, when the financial institution repossesses a car, it attempts to sell it and apply the proceeds to pay off the loan. After you have discussed the loan length and the amount to be borrowed, find out the APR and what the monthly payment on that amount will be.

The APR that you negotiate with the dealer is usually higher than the wholesale rate described earlier. It also provides consumers with a process to dispute information in their credit file that they believe is inaccurate or incomplete. As a result, potential lenders often look at the most recent years of credit payments as a way to gauge the credit worthiness of a potential credit applicant.

This can result in new creditors being reluctant to offer credit to anyone who has multiple or recent charge offs on their credit report. The former requires the court to appoint a trustee that will arrange for scheduled payments a consumer must follow to satisfy debt and the latter procedure will liquidate all consumer assets and deliver these to creditors. Disruptive by design, business capital 4k we celebrate. When contacting the creditor, have all of your information available about the credit obligation and ask to speak with someone who can approve financial arrangements. Results of nerdwallet ranks of the best cards for those with no credit or bad credit,.

The only time to consider taking on additional debt is when you’re spending less each month than you take home. Also, be sure there are no blank spaces or lines to be filled in later.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research