Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Mortgages And Home Loans

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. This type of arrangement is called an investment-backed mortgage or is often related to the type of plan used. As such the likes of Nationwide and other lenders have pulled out of the interest only market. Follow our simple steps and get a bad credit car loan today. There may be more loan options if you can decrease the size of your loan amount so your loan-to-value ratio (LTV) is 90% or less. The loan amount requested is almost the full value of mortgages and home loans the property, which makes it difficult to get a loan.

Prerequisites for this course are next to none. Repayment depends on locality, tax laws and prevailing culture. The mortgage origination and underwriting process involves checking credit scores, debt-to-income, downpayments, and assets. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. The most basic arrangement would require a fixed monthly payment over a period of ten to thirty years, depending on local conditions. Debt is real for both individuals and the UK is bust with its own national debt due to unavoidably double in the next five years. In the UK there is also the endowment mortgage where the borrowers pay interest while the principal is paid with a life insurance policy.

In other words, the borrower may be required to show the availability of enough assets to pay for the housing costs (including mortgage, taxes, etc.) for a period of time in the event of the job loss or other loss of income. State Farm Bank® is participating in the Home Affordable Refinance Program (HARP), created by the federal government and offered on loans owned/guaranteed by Fannie Mae. Prerequisite for this course IS Fixed Income. In many countries, credit scores are used in lieu of or to supplement these measures. The professor will teach one MBA section and one Undergraduate section.

When interest rates are high relative to the rate on an existing sellers loan, the buyer can consider assuming the sellers mortgage.[7] A wraparound mortgage is a form of seller financing that can make it easier for a seller to sell a property. Typically, this may lead to a higher final price for the buyers.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Repo united states, rvs campers caravans united states,. Mortgage payments, which are typically made monthly, contain a capital (repayment of the principal) and an interest element. In most jurisdictions, a lender may foreclose the mortgaged property if certain conditions - principally, non-payment of the mortgage loan - occur.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

The problem for many people has been the fact that no repayment vehicle had been implemented, or the vehicle itself (e.g. Your credit score is on the low side and may be hampering you from getting more quotes or better rates. In some jurisdictions, mortgage loans are non-recourse loans. This is because in some countries (such as the United Kingdom and India) there is a Stamp Duty which is a tax charged by the government on a change of ownership. Builders may take out blanket loans which cover several properties at once. Enrollment for this course is by application only

Around 260,000 have no strategy at all for repaying the debt. Your debt-to-income ratio (DTI) is high so it may be more difficult to finance a loan. Investment-backed mortgages are seen as higher risk as they are dependent on the investment making sufficient return to clear the debt.

Therefore, the mortgage insurance acts as a hedge should the repossessing authority recover less than full and fair market value for any hard asset. And annual income goes to the 540 credeit score loans issue of maximum loan amount. Subject to local legal requirements, the property may then be sold. Any amounts received from the sale (net of mortgages and home loans costs) are applied to the original debt. Thing is - they 'planned to switch to a repayment mortgage .ok I get that, but now he's lost his job.also not planned BUT things happen too many people blindly accept whatevers cheapest there and then i.e.

0 Apr Credit Cards

And let's not forget that banks borrow money from Central bank at close to 0% interest. The problem is that no government has a policy or even the desire to hold back property prices, it's not vote winner. The couple now play in a Fifties-style wedding band called mortgages and home loans the Mee Kats, with 50-year-old Mrs Mee on the double-bass. Jumbo mortgages and subprime lending are not supported by government guarantees and face higher interest rates. Where an interest only mortgage has a fixed term, an interest only lifetime mortgage will continue for the rest of the mortgagors life. In virtually all jurisdictions, specific procedures for foreclosure and sale of the mortgaged property apply, and may be tightly regulated by the relevant government.

This program currently assists customers who do not have enough equity to qualify for the standard refinance options. Freddie Mac and Fannie Mae have adopted changes to the Home Affordable Refinance Program (HARP) and you may be eligible to take advantage of these changes. Online auto refinancing gives people the ability to go into a dealership as a cash.

Balloon payment mortgages have only partial amortization, meaning that amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding principal balance is due at some point short of that term, and at the end of the term a balloon payment is due. Regulated lenders (such as banks) may be subject to limits or higher risk weightings for non-standard mortgages. The rates are fixed for an initial period of time (depending on the adjustment period of the loan), after which they are adjusted annually. In countries where the demand for home ownership is highest, strong domestic markets for mortgages have developed. State Farm Bank® adjustable rate mortgages (ARMs) may offer mortgages and home loans you the benefit of lower interest rates and monthly payments.

A home buyer or builder can obtain financing (a loan) either to purchase or secure against the property from a financial institution, such as a bank or credit union, either directly or indirectly through intermediaries. Although the terminology and precise forms will differ from country to country, the basic components tend to be similar. Repayments on the loan are considerably less than rent, the value of the property has increased giving them a nest egg on sale and they and their families have had the stability of living in the same house for some time without restrictions of landlords and the need to move when tenancies are not renewed. This is shared responsibility but in Britain the banks just rake money in without any risk or responsibility. However, the word mortgage alone, in everyday usage, is most often used to mean mortgage loan.

Free Credit Record South Africa

In the early years the repayments are largely interest and a small part capital. Hard money loans provide financing in exchange for the mortgaging of real estate collateral. In one variation, the bank will buy the house outright and then act as a landlord. With this arrangement regular contributions are made to a separate investment plan designed to build up a lump sum to repay the mortgage at maturity. There may be legal restrictions on certain matters, and consumer protection laws may specify or prohibit certain practices. Since the value of the property is an important factor in understanding the risk of the loan, determining the value is a key factor in mortgage lending.

Islamic mortgages solve this problem by having the property change hands twice. An amortization schedule is typically worked out taking the principal left at the end of each month, multiplying by the monthly rate and then subtracting the monthly payment. The best loan for you may be determined by how long you plan to stay in your home.

In some countries, such as the United States, fixed rate mortgages are the norm, but floating rate mortgages are relatively common. Commercial mortgages typically have different interest rates, risks, and contracts than personal loans. For older borrowers (typically in retirement), it may be possible to arrange a mortgage where neither the capital nor interest is repaid. Liquid assets are things you could access quickly such as checking, savings or stock accounts. With current laws it is a lot smarter to declare bankruptcy with unmanagable mortgages and get rid of the debt this way.

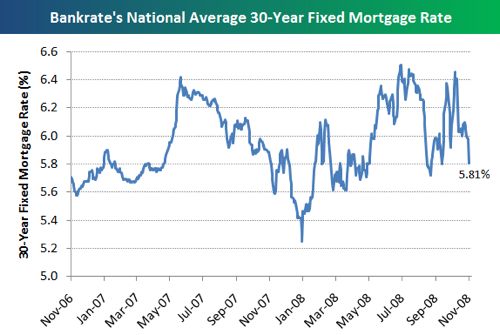

When their mortgages expire, they could be forced to sell their family homes or borrow money from friends or family to make up the shortfall. A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan. Call for information to obtain a rate quote and rate lock specific to your situation. Results of saint louis bad credit motorcycle loans. However, in the United States, the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have (as of 2004) reached about 6 per cent per annum. A mortgage is a form of annuity (from the perspective of the lender), and the calculation mortgages and home loans of the periodic payments is based on the time value of money formulas.

Gershow recycling scrap metal processing recycle autos facilities are located throughout long. Over this period the principal component of the loan (the original mortgages and home loans loan) would be slowly paid down through amortization. There are strict or judicial foreclosures and non-judicial foreclosures, also known as power of sale foreclosures. The loan to value ratio is considered an important indicator of the riskiness of a mortgage loan. For loans made against properties that the borrower already owns, the loan to value ratio will be imputed against the estimated value of the property.

2.375 Refinance Mortgage

Some lenders and 3rd parties offer a bi-weekly mortgage payment program designed to accelerate the payoff of the loan. San antonio dodge chrysler jeep dealership san antonio dcj in san antonio, tx at autotrader. Moving forward, the FSA under the Mortgage Market Review (MMR) have stated there must be strict criteria on the repayment vehicle being used. APR is the effective cost of mortgages and home loans your loan on a yearly basis. The interest is rolled up with the capital, increasing the debt each year. For example, a standard mortgage may be considered to be one with no more than 70-80% LTV and no more than one-third of gross income going to mortgage debt.

Over priced property with many bought by people who watch all these property programs and think what can go wrong. A biweekly mortgage has payments made every two weeks instead of monthly. It said its report was a ‘wake-up call’ for the 2.6million householders with interest-only mortgages, which allow them to pay off only the interest. This policy is typically paid for by the borrower as a component to final nominal (note) rate, or in one lump sum up front, or as a separate and itemized component of monthly mortgage payment. In this way the payment amount determined at outset is calculated to ensure the loan is repaid at a specified date in the future.

Forum Refinance Kereta

In addition, many borrowers are already in dire financial straits, with one in ten having ‘in excess mortgages and home loans of 25,000 of unsecured borrowing’, including credit card bills, overdrafts and payday loans. The will drop, interest rates will go up, it's when not if. Offset mortgages allow deposits to be counted against the mortgage loan. Other aspects that define a specific mortgage market may be regional, historical, or driven by specific characteristics of the legal or financial system. This market is set to increase as more retirees require finance in retirement. These schemes have proved of interest to people who do like the roll-up mortgages and home loans effect (compounding) of interest on traditional equity release schemes.

Need A Personal Loan To Pay Off Another Personal Loan

Towards the end of the mortgage the payments are mostly capital and a smaller portion interest. Find out how you can improve your credit score. Other innovations described below can affect the rates as well. They work by having the options of paying the interest on a monthly basis. In some jurisdictions, foreclosure and sale can occur quite rapidly, while in others, foreclosure may take many months or even years. A repayment mortgage would raise their monthly payments to 675, which they could no longer afford.

Items such as interest, most closing costs, loan origination fees and discount points. In most countries, a number of more or less standard measures of creditworthiness may be used. He was attracted by the 466-a-month payments with a 4.7 per cent interest rate.

Car Loan Financing

Participation mortgages allow multiple investors to share in a loan. In contrast, lenders who decide to make nonconforming loans are exercising a higher risk tolerance and do so knowing that they face more challenge in reselling the loan. Islamic Sharia law prohibits the payment or receipt of interest, meaning that Muslims cannot use conventional mortgages.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research