Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Refinance Your Car

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. This customer may have bought the car on a short-term loan — say, two years. Unless you’re seriously in danger of missing payments or defaulting on your loan altogether, avoid refinancing into a loan that would extend your current one. Private bad credit lenders have created private lenders for high risk and bad credit people loans especially for people with bad. However, the criteria is far less stringent than that associated with home loans, says Reed. Additional terms and conditions refinance your car may apply.

Prerequisites for this course are next to none. By refinancing at a competitive rate, the monthly payments would be slashed, and all it takes is about 10 minutes to fill out the application. It is not, however, for people looking to save money in the long run, because it increases the overall cost of the loan. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Also, creditors may limit refinancing options on aging vehicles because the collateral (your aging car) wont have enough resale value. The table below shows what you'll pay if you continue with that same loan, refinance your car versus refinancing the final four years of the loan at 5.5 percent. Thats why some approved customers close their car refinance loans the same day they apply. Possibly, they anticipate the same kind of application-heavy process found in refinancing a home loan.

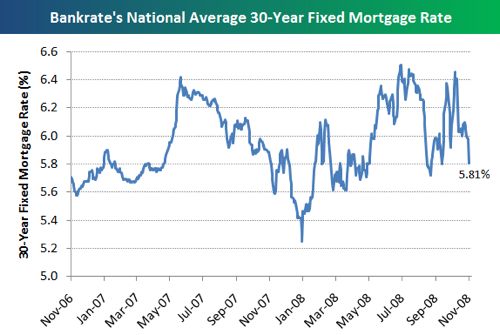

Today, the average rate on a 36-month used-car loan is 5.47%, according to Bankrate. Refinance your car and save money, or just lower your monthly payment by extending the length of your loan. Prerequisite for this course IS Fixed Income. Jack Nerad, executive editorial director and market analyst for Kelley Blue Book advises anyone in a lengthy auto loan (with an original five- to eight-year term), to research auto refinancing. The professor will teach one MBA section and one Undergraduate section.

Your situation is different than most people who can seek a clearance based on a previous investigation. Knowing a vehicles performance, maintenance history and reliability can certainly be a plus.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Results of home find grant opportunities search grant. Heres another example with the same $16,500 loan for 60 months mentioned above. Its like finding a wad of cash you didnt know you had in your clothes after doing the laundry.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Other examples could well be more dramatic. The table also shows whether a fee is charged; contact information is given, too. If it is not known how compensation is handled at the time one decides to apply for a job, the job interview is an appropriate time to inquire about that. The results offered are estimates and do not guarantee available loan terms, cost savings, tax benefits, etc. Once approved for an auto loan refinance, how long will it take to close my loan. Enrollment for this course is by application only

Another refinancing strategy — if you can afford it — is to secure a lower interest rate and its resulting lower monthly payments, but keep paying the same amount you were paying before. Even if it would only reduce your annual interest payments by around 1 percent, refinancing is worth a look. This is good for you because refinancing auto loans makes your monthly car loan payments lower, and your interest rate drops, which can allow you to pay off the balance of your car loan even quicker.

What APR % should you look to refinance a car at. As with any rate-based loan, negotiation is always an option, but Reed acknowledges that particularly when dealing with large banks, auto refinancing interest rates may be fairly fixed. Please call Wells Fargo Education Financial Services at 1-800-658-3567 if any portion of the proceeds is to be used for educational purposes, or to refinance/consolidate any loan you incurred for such purposes.

Build A Resume In 15 Mins

It is healthy to disinfect your license's refinance your car surface every now and then. Apply for new car loans, used car loans, or auto loan refinancing at the official. Used the following link to see how much your payments will change. Many of your questions should focus on potential problems and maintenance issues. Buyer's remorse sets in…and the search for a new auto loan begins. Search all boats for sale and find one for the deal of a lifetime.

Doing a "buyout" — where the customer actually purchases the car and establishes a loan — is a smart move. Refinancing the auto loan is just the ticket to do that. These loans are less common, but make sure to check if this is what you've signed up for.

Then, a neighbor or friend innocently asks, "So what interest rate did they give you." The car owner goes back to her contract and finds that the dealer made a pretty penny on her by marking up the interest rate by several percentage points. You can get your credit report instantly online from Experian, TrueCredit or Equifax. Copyright 1999-2005 Alphalink Technologies.

Many consumers find that they want to keep their car at the end of their lease. If I refinance my existing auto loan, do you send the payoff check directly the original lender or to me. Many people only pay attention to their monthly payment when purchasing a car and have no idea how much of that payment is interest. Unlike refinancing your mortgage or even consolidating credit card balances, refinance your car refinancing your vehicle loan is usually quick, easy and painless. How do I benefit by auto loan refinancing.

Unlike refinancing a mortgage, auto refinancing is quite painless, according to Reed. Mortgage rates are likely to stay 4.0 30 yr mortgage rates below through the middle of, look. APR shown assumes excellent borrower credit history. The "gentle" lenders that we recommend here like Capital One Auto Finance, Up2Drive and myAutoloan.com do not have any fees. APR is effective as of 11/1/2012 and subject to change.

Use the money you save to pay off credit card refinance your car debt or accelerate your car loan payoff. Car refinance is the same as home refinance. The board may increase the amount of the fee to an amount that is more than 10 percent of the amount imposed in the preceding academic year if that increase in the fee is approved by a majority vote of those students participating in a general election called for that purpose. If you are applying for this auto loan refinance with another person, and this person agrees to apply jointly, you will need to have his or her ID, residence, job and income information, too.

The products and services offered through Nationwide Investment Services Corporation are subject to investment risk, including possible loss of value. As with any loan, you do need good credit to qualify for auto refinancing. Using Bankrate's auto interest rate search engine, you can input your ZIP code and find banks in your area offering refinancing and their rates. Some lenders can make you pay a portion of the remaining interest when you refinance, not just what's left on your principal. You’ll also pay less over the life of your loan.

There may also be prepayment penalties in your original loan agreement that can make refinancing a costly option. According to FICO (the company that calculates the widely-used FICO scores), you need a FICO score of 720 or more to qualify for the best auto loan rates. You’ve likely heard about the benefits of refinancing a home loan. I highly recommend you either use that savings to payoff your high 18% APR credit cards, or send in extra principle on your already lowered auto refinancing loan and pay it off even sooner, and save even more money on interest. This is only an example of how relying on a vehicle to consolidate bills could help reduce monthly payment. The longer the term of the loan, the more interest you’ll fork over to the bank until it’s paid off, even if your monthly payment seems low.

For instance, using the example above, if you continued to pay $622 a month after refinancing the loan, you would have your car paid off after about 45 months, rather than 48 months. Lower your home loan repayments with car loan interest rate kuching rhb my home loan and do the things. Home repair involves the diagnosis and resolution of problems in a home, and is.

Pawn Your Jewelry

With today’s low interest rates, those who have enough equity in their home and the credit required for a refinance could lower their monthly payments considerably. Cash fairy is an online cash advance payday loans company offering short term. To find a better rate, though, refinance your car you'll need to shop around. Request a car insurance quote from Nationwide Insurance today. And say there were a few dings on your credit so the dealer told you that refinance your car your auto loan would be 11 percent on a five-year loan for a $23,000 car. Call 1-866-452-3413 or visit your local Wells Fargo store for your evaluation.

Hsbc Letters Of Credit

A car owner may have recently bought a new vehicle and financed it through the dealership. Car refinancing has become a very popular trend with dropping interest rates. Auto refinancing is one of the best kept secrets around for saving you money, but most people never thought of refinancing their car. Site Map | Responsible Lending | Wells Fargo & Company. It could simply be that people don't know it is possible. Other features that merit mentioning are the solid wood cabinets, the power windshield refinance your car day/night shade, power driver seat, and power passenger footrest.

Suppose you already got a good 7% APR car loan. Find out how Nationwide Bank can help refinance your car you pay less on what you borrow. After all, the only risk is the 5-10 minutes it takes to fill out the application. It can often be handled online, and might take just one or two hours to complete. That's a savings of nearly $6,000 refinance your car over the life of the loan.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research