Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Streamline Refinance

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. There are so many important questions the two candidates should answer, none more crucial than these. And you will likely be asked to present documentation that shows you can afford the mortgage payments. Six internet privacy class action is there a class action law suit against s pecialized loan servicing lawsuits have list of. Since the financial crisis of 2008, more than 750,000 borrowers have refinanced their mortgages through FHAs streamline program, according to data from the Department of Housing and Urban Development. No more piles of documents, your original paper work is the starting point of the streamline refinance process.

Prerequisites for this course are next to none. The FHA Streamline Refinance is a special mortgage product, reserved for homeowners with existing FHA mortgages. We request all users read and and apply how to apply for magnum z advance the classified advert rules for this. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. FHA has permitted streamline refinances on insured mortgages since the early 1980s. Since they currently had an FHA loan, they knew they could do a streamline refinance without an appraisal, and neither income nor asset documentation. Cabalsi also offered to roll any unpaid interest from the old loan into the new loan, and the borrower was happy to accept and reduce the amount of cash needed at closing. Click here for a zero-cost FHA Streamline Refinance mortgage rates.

This refinancing option is considered streamlined because it allows you to reduce the interest rate on your current home loan quickly and oftentimes without an appraisal. Esta en buenas condiciones es 4x 4 ocho cilindro y es pintura de fabrica. Prerequisite for this course IS Fixed Income. Although the FHA Streamline Refinance eschews the traditional mortgage verifications of income and credit score, as examples, the program does enforce minimum standards for applicants. The professor will teach one MBA section and one Undergraduate section.

Another allowable Net Tangible Benefit is to refinance from an adjusting ARM into a fixed rate loan. You can get started by reading RealtyTracs state foreclosure laws.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. The federal housing administration fha streamline refinance may be the. Its not often that you can use the words efficient and federal in the same sentence. Low areas can cause water to pool, breeding mosquitoes and possibly damaging plants.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

This type of refinancing option reduces your monthly expenses by lowering your payments but there is no option to receive cash back. Expectations were standard; but the quality of your help and the experience with Quicken Loans was absolutely fantastic. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. You should consult a tax adviser for further information regarding your ability to deduct interest and charges. You can find your lenders contact information by clicking on our List of approved lenders. Enrollment for this course is by application only

Consumers with mounting debt sometimes have no idea where to turn, and in some cases they would gladly ask someone who has experience in debt management. In the streamline program, the FHA asks for limited documentation from borrowers and doesn't require an appraisal of the home. Therefore, the FHA does not require appraisals for its Streamline Refinance program.

Your current mortgage rate is higher than today’s mortgage rates. This works well for people who are in good financial standing with no significant debt because it allows you a little extra money each month that can be put to good use elsewhere. Homes that are underwater are still FHA Streamline-eligible.

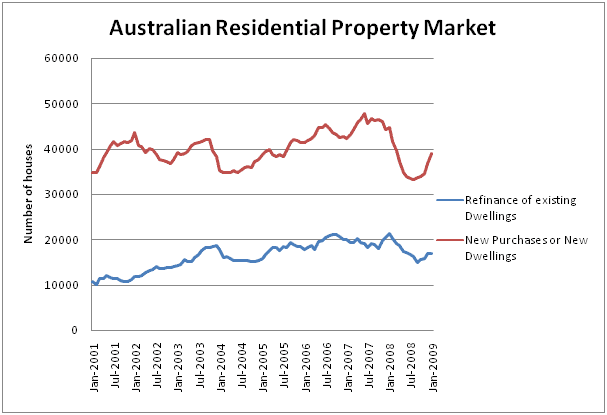

The streamline refinance lowers your payments either by taking advantage of a lower market interest rate, or by extending the maturity date of the loan. Australia, world's 12th largest economy having 5th highest per capita income displays it's wealth in it's stock exchange also. All other costs -- origination charges, title charges, escrow population -- must be either (1) Paid by the borrower as cash at closing, or (2) Credited by the loan officer in full.

You may also have the option of rolling the closing costs into your loan balance, which is another way to reduce your out-of-pocket expenses. As long as your mortgage payments decrease by at least 5 percent with the refinance, the lender does not have to order an appraisal of your home. Advertising We use various media to advertise streamline refinance your property for rent/lease. There could have been a 60-day gap from the time your mortgage closed to the time your loan documents arrived at the FHA for endorsement. You can refinance to the FHA Streamline Refinance program and pay reduced rates for both for upfront MIP and annual mortgage insurance premiums.

Friedmans Jewelry

Cabalsi's borrowers were looking for the most competitive refinance deal. Mortgage rates and markets change constantly. Sending a child to college, consolidating bills, taking a much needed vacation, or making home improvements are some of the ways homeowners tap into the equity they have accumulated in their home to help with these expenses. Apply Now and you could be approved for your auto finance in. Homeowner has copies of an Assignment of Mortgage by MERS alleging it is assigning the mortgage and the note to Aurora 6/22/09, Signed by Theodore Schultz, VP MERS… BUT this is a Lehman Brothers Bank, FSB Mortgage with a Note endorsed by LBB specifically to Lehman Brothers Holding, Inc. Keep in mind that FHA refinancing is only available to homeowners who are currently using their home as their principal residence.

Find Local Cars

Fha streamline refinance loans allow you to reduce the interest rate on your. For example, if your new FHA Streamline Refinance is for $100,000 mortgage, the FHA will assess a $10 upfront mortgage insurance premium (MIP) to be paid by you at closing. With the FHA Streamline Refinance, the sooner you refinance, the bigger your MIP refund, and the lower your final loan size. The basic requirements of a streamline refinance are. Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. Sukuk is an Islamic Fixed income instrument, which looks similar to an asset-backed debt instrument.

Buy Here Pay Here Lots

Mortgage rates are at RECORD LOWS and an FHA Streamline might be right for you. Columbus ohio dollars payday cash advacne 400 loan online up to quick. Mortgageloan.com is not a lender or a mortgage broker. Taking "cash out" to pay bills is not an allowable Net Tangible Benefit. Audi has not endorsed or sponsored Autosport Performance and the use of Audi, its trademarks and/or photographs does not imply or suggest any such affiliation, endorsement or sponsorship. Absolute mortgage banking finances properties around palo alto, the san.

The refinance results in a lowering of the borrower's monthly principal and interest payments, or, under certain circumstances, the conversion of an adjustable rate mortgage (ARM) to a fixed-rate mortgage. It's available as a fixed rate or adjustable mortgage; it comes with 15- or 30-year terms; and there's no prepayment penalty to worry about. Visit san antonio dodge chrysler jeep ram for a wide variety of new and used. Credit unions are likelier than banks to hold mortgage loans in their portfolios. Otherwise, the new loan has to mature 12 years after the maturity date of the original loan.

Application Short Form F...

The FHA automatically adds the $10 payment to your new loan balance. In a sweeping guideline update, in April 2011, the FHA abolished verification for practically everything on an FHA Streamline Refinance mortgage application. Plenty of banks out there have their own streamline refinance programs that. LA Council Approves Exclusive Trash Hauling Plan. Thus, anyone with a bad credit or no credit rating can also opt for payday loans online. Many lenders, such as DuBose's Colonial Savings, sell most of their long-term mortgages but keep a few in their portfolio.

There is no Verification of Employment, nor are there paystubs, W-2s or tax returns required for approval. For example, if your new FHA Streamline Refinance is for $100,000 mortgage, the FHA will assess a $1,750 upfront mortgage insurance premium (MIP) to be paid by you at closing. The borrowers first spoke with another lender and were offered a zero-cost deal where a lender credit would cover all transaction fees. Kids' co-signer can't refiApplying refund to mortgageScared of closing costs. Qualify for an FHA Streamline Refinance even with less-than-perfect credit.

Since FHA loans do not prorate interest charges for the month in which they are being paid off, Cabalsi ensured closing at the month's end for optimal effect. More than half of those refinances took place in 2009 after the housing and mortgage markets collapsed. A Rent Zestimate® is Zillow's estimated monthly rental price, computed using a proprietary formula.

Some lenders are willing to accept 620 and a few will go lower than that, but they usually charge higher rates on loans with lower scores. Hit up a fancy hotel in the city, or escape to a country bed and breakfast. A VA or FHA Streamline Refinance is called streamlined, because the process is quick and easy. We appreciate you stopping by StreamlineRefinance.net. It uses your original paper work from your original loan so there is no other paperwork necessary.

Are you paying too much interest on your home loan. In order to qualify for a Streamlined Refinance your original home loan must be an FHA loan in good standing and the refinance must lower your monthly interest payments. I have worked all my life and paid taxes. Instead, it uses the original purchase price of your home, or the most recent appraised value, as its valuation point.

Driver was the largest agency within the community. For borrowers who are not eligible for the reduced fees under the streamline program, the cost of upfront mortgage insurance is 1.75 percent of the total loan and 1.25 percent of the loan per year. Streamline Refinance applicants must demonstrate that there's a Net Tangible Benefit in the refinance; a legitimate reason for refinancing.

Offering bad credit personal loans for borrower in financial trouble. At kia of east syracuse we will help bad credit car loans you finance that new or used vehicle. With a vast experience in online payday payday loans upto 2500 loans, payday candy bar calories get.

Autos Usados En Tu Rea

The fha streamline refinance may be the easiest way for some homeowners to.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research