Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Need A Personal Loan To Pay Off Another Personal Loan

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. The interest rate is locked and doesnt change for the life of the loan. Westpac will receive commission payments as a result of the arrangement of Westpac Life-NZ-Limited Insurance policies. No credit check truck program, semi trucks, bank repo semi trocks used semi, big rig big rig, big. Amusingly enough, debt consolidation loans are a bear to get. This includes reporting late payments to the credit bureaus, hiring need a personal loan to pay off another personal loan a collection agency, and filing a lawsuit against you.

Prerequisites for this course are next to none. The bank will probably want to know what youre going to use the money for and may even have a better loan for your needs. So, if you default on a personal loan, the lender cant automatically take a piece of your property as payment for the loan. This MBA course and registration will be through the MBA Auction.

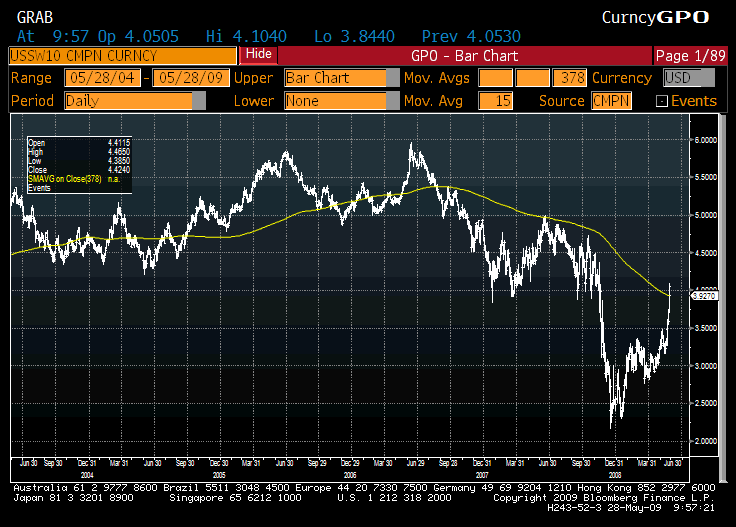

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Before you go get a loan from the bank, you might try the following ideas. Bankrate wants to hear from you and encourages need a personal loan to pay off another personal loan thoughtful and constructive comments. Even though the lender cant automatically take your house or car, it can take other collection actions. This information is a guide only and does not take into account your personal financial situation or goals.

The application process for small business loans feels like being marooned on a deserted island surrounded by a sea of paperwork. If you just make minimum payments on your credit card, your balance comes down minimally and will take bookoo years to pay off. Prerequisite for this course IS Fixed Income. At least get a lower rate card and even better, a term (3 or 4 yr. The professor will teach one MBA section and one Undergraduate section.

Debt Management & Elimination Frugal Food & Cooking Financial Independence Site, Product & Book Reviews Recipes Money Management Frugal Beginnings Home & Family Holidays & Birthdays Stretch Your Shopping Dollars Self-Sufficient Living Gardening Stages of Life Singles Only Schooling, Public & Homeschool Hobbies & Crafts Living Green Can You Help. Unless you can be very self-disciplined (And be honest with yourself; can you.), Id pass this opportunity up.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Brisbane payday loan north vernon payday cash loans in 1 hour loan porter payday loan cash. After youve paid off your CCCS agreement, it takes about 6 months to a year for your image to be un-tarnished with mortgage companies and others, but if you can deal with the wait for that, its definitely worth it. We’ll let you know how much you could borrow, and with the bargaining power of a cash buyer, you may just get a much better deal.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

For example, you may have a lower interest rate with shorter repayment periods. I realized that I was not living within my means and it has caused me great heartache. Are you planning on buying a house or making another major purchase anytime soon. Taking out a personal loan doesnt pay off your plastic. Youd consider doing it if you can get some combination of the following financial outcomes. Enrollment for this course is by application only

One day I was checking out a debt program I had downloaded and was shocked at how long it would take to pay these cards off and how much they really cost when paying the minimum payments. And we're way too old to worry about keeping up with the Jones's. Bankrate's national average rate for fixed-rate cards is 13.81 percent; for variable-rate credit cards, it's 14.52 percent.

A personal loan is typically an unsecured debt, just like a credit card is unsecured debt. Your loan payment can be calculated using the loan balance, interest rate and the loan term. I'm sure debt consolidation is a valuable tool, but unless it is used in conjunction with a balanced budget, you could easily find yourself in the same mess as before, only worse, especially since you will suddenly owe nothing to the credit card companies.

Fast cash payday loans online fast payday loans with aaapaydaycash com. The better your credit score, the lower your interest rate. No sense wringing your hands over the solution until you are sure that this is even an option.

Come to find out that the loan's finance charge was actually 18% and the only way to get the interest rate down was to file the finance charges at income tax time. This Week In Family Automobiles Babies Budgeting Cash Management Children Christmas Clothing College Crafts Daycare Debt. Transfer the balance then cut the card up and pay cash for things. Will this affect me when I go to buy a house or rent an apartment.

What is the answer is to scale down one's lifestyle dramatically. There are a number of ways that we can help keep your loan simple. This is the primary reason that personal loans are more difficult to get.

First, call the credit card companies and ask them to reduce your interest rate and waive the annual fee. Please remember that your use of this website is governed by Bankrate's Terms of Use.advertisementRelated Links. Personal loans are often more difficult to get and have strict qualification requirements.

San Antonio Cdjr Dealer

Meats & Poultry Meals on the Go Organizing Recipes & Coupons Pantry & Food Storage Price Books need a personal loan to pay off another personal loan Recipes Restaurants Saving Time Shopping Tips & Tricks Snacks & Desserts Warehouse Clubs. I find myself starting over at 27 years old, married with two children and having to move my family out of our home and into an apartment, all because I lived above my means and a consolidation loan did not help me changed my spending habits it provided temporary relief. SmartSource Coupons.com eBates Organize Your Coupons Online Coupon Codes TDS Coupon Library. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. As long as you make the minimum monthly payments on your need a personal loan to pay off another personal loan cards, there's no defined loan term on credit card debt. Westpac Life-NZ-Limited is a wholly owned subsidiary of Westpac Financial Services Group-NZ-Limited, which need a personal loan to pay off another personal loan is a wholly owned subsidiary of Westpac Banking Corporation ABN 33 007 457 141, incorporated in Australia.

Many cards will do that if you have been a good customer and make your payments on time. What’s more, borrow from us, and normally you won't need to use your new boat or car as security for the loan. Natural Living Organization Pests Plumbing Property Management need a personal loan to pay off another personal loan Recycling Space Management Taxes Time Management Utilities. With a good credit history, you're likely to get a lower interest rate on a personal loan than you have on your credit cards.

Balance Sheet Excel Download

All advice should be weighed against your own abilities need a personal loan to pay off another personal loan and circumstances and applied accordingly. Is bankruptcy the answer.Which bills help credit.Credit help after a repo. Some travel agents have reported starting homebased travel business their home businesses for less than. Getting a personal loan to pay down cc debt need advice. The personal loan with fixed payments and years is the way to go if you can swing the payments. Have you ever considered working online online typists wanted as a typist from your home and.

Plus (+) or Minus (-) following ratings from ” AA’ to ” CCC’ show relative standings within the major rating categories. It sends a signal that you got in over your head and might again with a mortgage. Document that provides the loan applications essential financial and. His ideas and his snowball debt reduction plan are really great.

Bpibank Car Loan Financing

Westpac Loan Repayment insurance is underwritten by Westpac Life-NZ-Limited, a wholly owned subsidiary of Westpac Financial Services Group-NZ-Limited. More details of this and the underwriter can be found in the relevant policy document. Westpac Life-NZ-Limited complies with the practice standards of the Investment Savings & Insurance Association of NZ Inc. That means the loan doesn't require you to use an asset as collateral. Organization Parties & Entertaining Pets Recipes Recycling Refunding Single Living Space Management Time Management Vacations Voluntary Simplicity. My husband started calling the credit card companies and asked them for a lower interest rate.

Bankrate's content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. I was wondering if it s a good idea to take out a personal loan to pay off credit. My husband and I also fell into the evil trap of Mr. Comments are not reviewed before they are posted. I had less than 10,000 in credit card debt but I looked at how I was spending $$$ I did not really have.

If the answer is "No" or "Not in the next 3-4 years," then I would recommend Consumer Credit Counseling Service. I am thinking that it would be better to get a 2 or 3 year personal loan from my credit union at 11.65% rather than the 21% and fees some of my cards charge. Compare Credit Card Offers Free Annual Credit Report Monitor Your Credit Free Bankruptcy Advice Debt Relief Mortgage Relief Tax Relief Collection Complaints Credit Card Calculators Debt Management Calculators TDS Credit Library TDS Debt Library. Paying down the balances is both a positive and a negative for your credit score.

Personal loans are one of many types of loans you can borrow from a bank. Second, if the interest rates are still higher consider doing some shopping for new credit cards. The better your credit score, the more money you can borrow for a personal loans. If you're thinking about borrowing a personal loan, here are some things you know about them.

We made out a long range plan that included extra payments on these cards and will cut the time and amount we will be paying considerably. Click here for Westpac's QFE Group disclosure statement under the Financial Advisers Act. This Week In Baby Boomers Finances Funerals Health.

The amount of personal loans ranges anywhere from $1,000 to $50,000 and depends on your credit rating. TDS Grocery Pricebook Meat Cost-per-Serving Calculator Compare Local Grocery Prices Meal Planning Tool Restaurant Recipes at Home TDS Grocery Library TDS Recipes. A personal loan will have a defined loan term, typically four to five years, so lengthening the loan term isn't the reason to restructure the debt.

A cash out refinance is a home loan in which cash out loans the borrower takes additional cash. By submitting a post, you agree to be bound by Bankrate's terms of use. Miscellaneous One Income Families Organization Parties & Entertaining Recipes Romance Savings School Single Parents Taxes Time Management Vacations.

Your question about the impact if you try to buy a home or rent an apartment comes down to your credit score, which would be checked by a mortgage lender or landlord. Dentistry Divorce Earning Money Education Expenses Family Activities Gardening Health Holidays Homeschooling Investments Marriage Medical Care. An island escape, a Caribbean Cruise — you don’t need to keep putting it off. Consolidating debts can be a lot like going on a liquid diet. It is subject to change without notification.

Start to build or re establish good credit today with a secured visa credit card. Compare Airline Prices Student Discount Travel Netflix eMusic.com iTunes.com Amazon Music TDS Travel Library TDS Activities & Entertainment Library. I had too many payments with too high an interest and wanted to consolidate them all under one payment with a lower interest. Continue to move your balances around to keep the lowest interest rate possible. The loan officer told me I had some of the best credit she had seen in a long time, but because of the large amounts I owed, I was considered a bad risk.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research